Export value for both U.S. beef and pork reached new heights in 2014, posting double-digit gains over the previous year’s totals, according to statistics released by USDA and compiled by the U.S. Meat Export Federation (USMEF).

Beef export value was $7.13 billion – an increase of 16 percent (and nearly $1 billion) over the previous record set in 2013. Export volume was just under 1.2 million metric tons (mt) – which was short of the 2011 record, but up 2 percent year-over-year.

Beef export value was $7.13 billion – an increase of 16 percent (and nearly $1 billion) over the previous record set in 2013. Export volume was just under 1.2 million metric tons (mt) – which was short of the 2011 record, but up 2 percent year-over-year.

Pork export value totaled $6.67 billion, an increase of 10 percent year-over-year, breaking the 2012 record by 6 percent. Pork export volume increased 2 percent to 2.18 million mt. The volume record is 2.62 million mt, set in 2012.

Exports overcame significant challenges to reach these milestones, including market access restrictions in Russia and China, an appreciating U.S. dollar and, most recently, shipping difficulties related to a labor dispute in the West Coast ports.

In December, beef export volume slipped 2 percent year-over-year to 100,270 mt, though value still increased 17 percent to $643.2 million. December pork export volume was down 5 percent to 183,498 mt, but value still achieved a slight increase to $541.3 million.

Source: U.S. Meat Export Federation (www.USMEF.org)

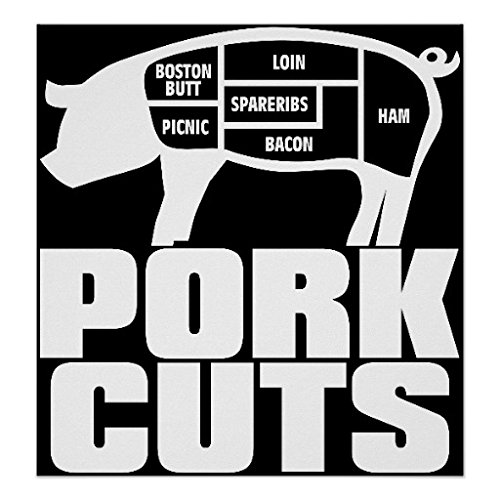

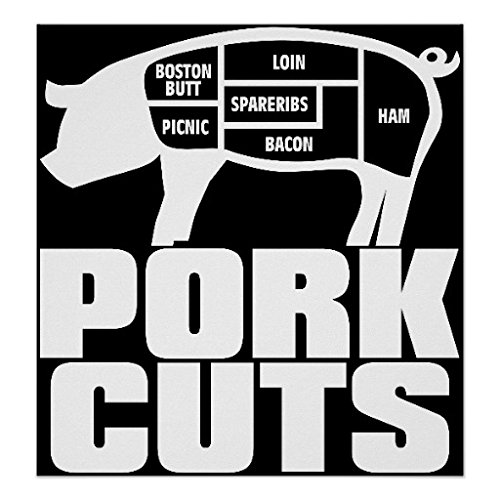

Artwork: Pork Cuts Poster

Farm Magazines

Pork

Farm Supply

Beef export value was $7.13 billion – an increase of 16 percent (and nearly $1 billion) over the previous record set in 2013. Export volume was just under 1.2 million metric tons (mt) – which was short of the 2011 record, but up 2 percent year-over-year.

Beef export value was $7.13 billion – an increase of 16 percent (and nearly $1 billion) over the previous record set in 2013. Export volume was just under 1.2 million metric tons (mt) – which was short of the 2011 record, but up 2 percent year-over-year.Pork export value totaled $6.67 billion, an increase of 10 percent year-over-year, breaking the 2012 record by 6 percent. Pork export volume increased 2 percent to 2.18 million mt. The volume record is 2.62 million mt, set in 2012.

Exports overcame significant challenges to reach these milestones, including market access restrictions in Russia and China, an appreciating U.S. dollar and, most recently, shipping difficulties related to a labor dispute in the West Coast ports.

In December, beef export volume slipped 2 percent year-over-year to 100,270 mt, though value still increased 17 percent to $643.2 million. December pork export volume was down 5 percent to 183,498 mt, but value still achieved a slight increase to $541.3 million.

Source: U.S. Meat Export Federation (www.USMEF.org)

Artwork: Pork Cuts Poster

Farm Magazines

Pork

Farm Supply