Thanks to increased global grain production and lower domestic demand for grain for ethanol, crop producers will find 2014 to be tougher than the past few years and should prepare now for lower prices.

Thanks to increased global grain production and lower domestic demand for grain for ethanol, crop producers will find 2014 to be tougher than the past few years and should prepare now for lower prices.“Prices reflect that we have moved from an era of scarcity to one of adequate inventories and prices have responded by moving lower,” said Matt Roberts, an Ohio State University Extension economist. “We are already seeing lower prices come into the market, and unless U.S. or South American acreage declines, those prices are likely to continue to move lower.

“The prices we had earlier in the year aren’t guaranteed to return.”

Thanks to several factors including no growth in ethanol demand and expanded global crop acreage, markets are moving back toward matching supply and demand, Roberts said.

Add another year of 160 or more bushels per acre yields on corn and 42 bushels per acre soybean yields, and growers can expect to see even lower prices that are well below the cost of production on land that has been purchased or cash-rented in the past three to four years, he said.

“Prices will only return to profitable levels if supply declines due to acreage leaving primary row crops or demand returns. This will likely create a significant financial strain in crop-growing areas.”

In order to prepare for the impact of lower prices, farmers should build a working capital cushion of a year to 1.5 years of land charges above what they typically need to operate.

Source:

Ohio State University College of Food, Agricultural, and Environmental Sciences

Market Watch

Nuts and Grains

Farm Supply

Farm Magazines

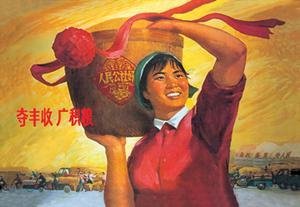

Artwork: Win a Good Harvest: Increase Grain Production