The fed cattle market was steady to a little higher this past week. Trade took place mid week with decent volume. Prices were mostly $97 on a live weight basis and were $152-154 on a dressed basis.

The fed cattle market was steady to a little higher this past week. Trade took place mid week with decent volume. Prices were mostly $97 on a live weight basis and were $152-154 on a dressed basis.Choice boxed beef prices were down more than $2 this week. The Choice-Select spread decreased slightly and remains at the typical level.

Feeder cattle prices were steady to lower this past week compared to last week’s prices. Montana prices were steady for 750 and for 550 pound steers. Nebraska prices were $1 lower for 750 and $4 lower for 550 pound steers. Oklahoma prices were $1.50 lower for 750 and $2.50 lower for 550 pound steers compared to last week.

Corn prices were a $.21 higher per bushel than last week. Dried Distillers Grain prices were $7 per ton higher and wet distillers grains were priced a little higher in Nebraska for the week.

Source:

Livestock Marketing Information Center

- Farm Supply

- Beef

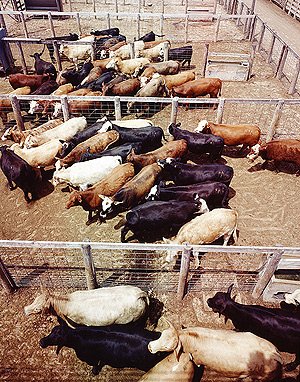

- Artwork: Cattle Feedlot